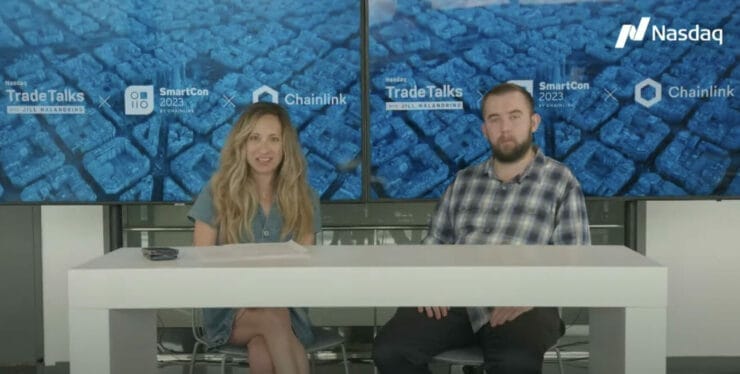

SmartCon 2023 featured more than 100 blockchain experts and financial industry leaders including founders of influential protocols in the Chainlink ecosystem. To get a closer look at the future of web3, Nasdaq TradeTalks host Jill Malandrino filmed a two-day interview lineup with speakers at this year’s event in Barcelona, Spain.

Chainlink co-founder Sergey Nazarov, whose SmartCon keynote explored how the Chainlink Network is evolving to power a new verifiable web, sat down with Malandrino to outline five levels of security that go into building a verifiable web and explain why blockchain interoperability is now “a hard requirement” for banks.

Nazarov defined the verifiable web as a more secure version of the internet “where people can know the systems they’re getting into before they join; they can know what’s going on in the system as they’re in it; and they can always choose to leave in a way that they verified before and in a way that’s under their control.”

As the industry-leading web3 services platform, which has already enabled more than $8.7 trillion in transaction value throughout the DeFi economy, Chainlink supplies blockchains with secure, verifiable data, computation, and cross-chain connectivity, which Nazarov considers three essential pillars of the verifiable web.

He described the verifiable web’s five levels of security as “the degrees to which you can create security through decentralization” using Chainlink oracle networks. Those five levels are: a single server, multiple servers controlled by a single private key holder, a single network of nodes, multiple separate networks, and finally multiple networks combined into a single service such as a decentralized data stream.

Nazarov also explained the recent paradigm shift toward a multi-chain world where each bank has its own private chain for creating tokenized real-world assets (RWAs). As a blockchain interoperability solution for more than 11,500 global banks using Swift’s financial messaging standard, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) unlocks the full potential of digital assets by allowing them to flow freely throughout the blockchain economy.

“Every single bank that has its own chain or is looking to make its own chain now understands that, without interoperability with other chains, they will be stuck on what they call a liquidity island,” Nazarov told Malandrino.

CCIP connects the diverse ecosystem of private bank chains and public DeFi applications into what Nazarov envisions as a single internet of contracts that would ultimately form “the world’s largest liquidity layer.”

“Banks now understand that, without a way to interoperate with their counterparties’ chains and with public chains, they won’t be able to be successful in whatever assets they create,” Nazarov said. “Interoperability is now a hard requirement.”

Watch Jill Malandrino’s full interview with Sergey Nazarov.