The goal of DeFi is to be a global and borderless financial system open to everyone. However, most liquid and widely used stablecoins are pegged to USD. This creates a lot of inefficiencies, because liquidity against USD provides the best price and lowest slippage on exchanges while liquidity against EUR, NGN, or JPY is virtually non-existent.

Pascal Tallarida is the founder and CEO of Jarvis Network, a DAO-owned set of protocols on Ethereum for universalizing and “uberizing” finance, especially financial products and markets. By “blockchainizing” traditional financial markets to make them open, transparent, interoperable and programmable, Jarvis protocols allow users to gain exposure to the prices of any financial instrument via margin trading and/or synthetic assets, as well as provide the liquidity required for these protocols to run smoothly.

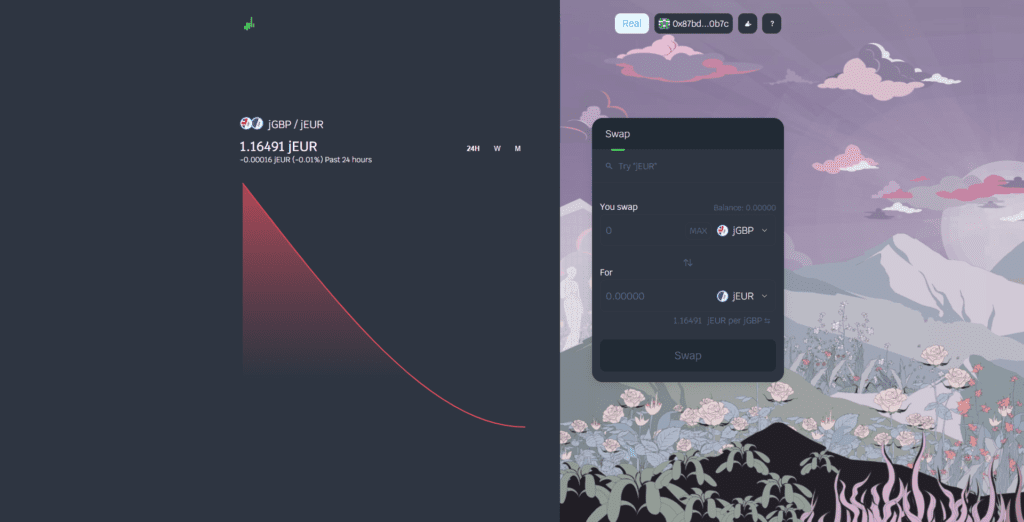

Tallarida said Jarvis’ primary innovation is the ability to mint the same synthetic assets using different minting logic. For example, Jarvis Synthetic Euro (jEUR) could be borrowed from the protocol (self-minting logic using oracles to price the collateral, similar to DAI) or it could be bought from a USD-stablecoin liquidity pool with the oracle used to price the synthetic asset (minting against a liquidity pool, similar to Synthetix). In the latter instance, different liquidity pools can co-exist with different logic, e.g. creating CFDs, futures, options, spot products, etc. Liquidity providers can choose which pool to provide liquidity to better manage their risks.

Non-USD tokenized stablecoins are highly capital inefficient because they require market makers and liquidity providers to create deep liquidity pools and thick order books. With USD-stablecoin liquidity pools and atomic swap (the exchange of one cryptocurrency for another without centralized intermediaries), Jarvis Synthereum protocol allows the creation of any ERC-20 token/non-USD stablecoin while leveraging from the USD-stablecoin deep liquidity, eliminating the need to create any new liquidity pools.

Tallarida initially began building an off-chain matching engine similar to the 0x open protocol that enables peer-to-peer assets exchange on Ethereum. “It was using meta-signature and a unique centralized price feed in order to have real-time price data. This off-chain infrastructure needed to be trusted and was too centralized, too heavy to maintain, and ultimately prevented composability,” he said.

However, this changed when Jarvis adopted Chainlink Off-Chain Reporting (OCR), which enables up to a 90% reduction in gas consumption and more frequent price updates while allowing DeFi applications to remain trustless and decentralized. “This helped us to considerably accelerate our go-to-market strategy with assurance that the prices come from multiple data sources,” Tallarida said. “OCR ultimately allowed half of our small team to work on the core of our project instead of focusing on building our own system.”

Tallarida believes that DeFi will soon coexist with and fill the gaps created by traditional finance, eventually competing for market share by creating value for all of its stakeholders. He sees Jarvis as a gateway to realizing DeFi’s potential; he’s also enthusiastic about sending compelling messages that further accelerate DeFi’s mainstream adoption.

“We won’t get adoption simply with DeFi narratives like ‘bank the unbanked’ or ‘finance without middlemen,’” he said. Instead, Tallarida is focused on explaining to people that DeFi allows them to make money by being their own banker, through self-banking services akin to self-driving cars.

In his view, mainstream adoption of DeFi is much more feasible than people make it out to be. “DeFi is simply recreating the same tools that exist in finance, but for everyone.”

To learn more about Jarvis, check out their Medium, Discord, Twitter, and read their research paper.

Elizabeth Licorish is a writer and author whose work has appeared in HuffPost, PhillyVoice and Bustle. In 2008, she wrote and co-authored Innovation for Underdogs. In 2010, she wrote and edited Charles Manson Now. She received her MFA in creative nonfiction from Rutgers University and has ghostwritten hundreds of executive thought leadership pieces for some of the world’s leading experts across diverse industries. She has been writing and editing for influential blockchain projects since 2017, when she fell in love with decentralized finance’s potential to empower individuals in an economically just world. As the editor-in-chief of Chainlink Today, she’s passionate about telling the human stories behind some of the most promising technology in the fastest-growing blockchain ecosystem.