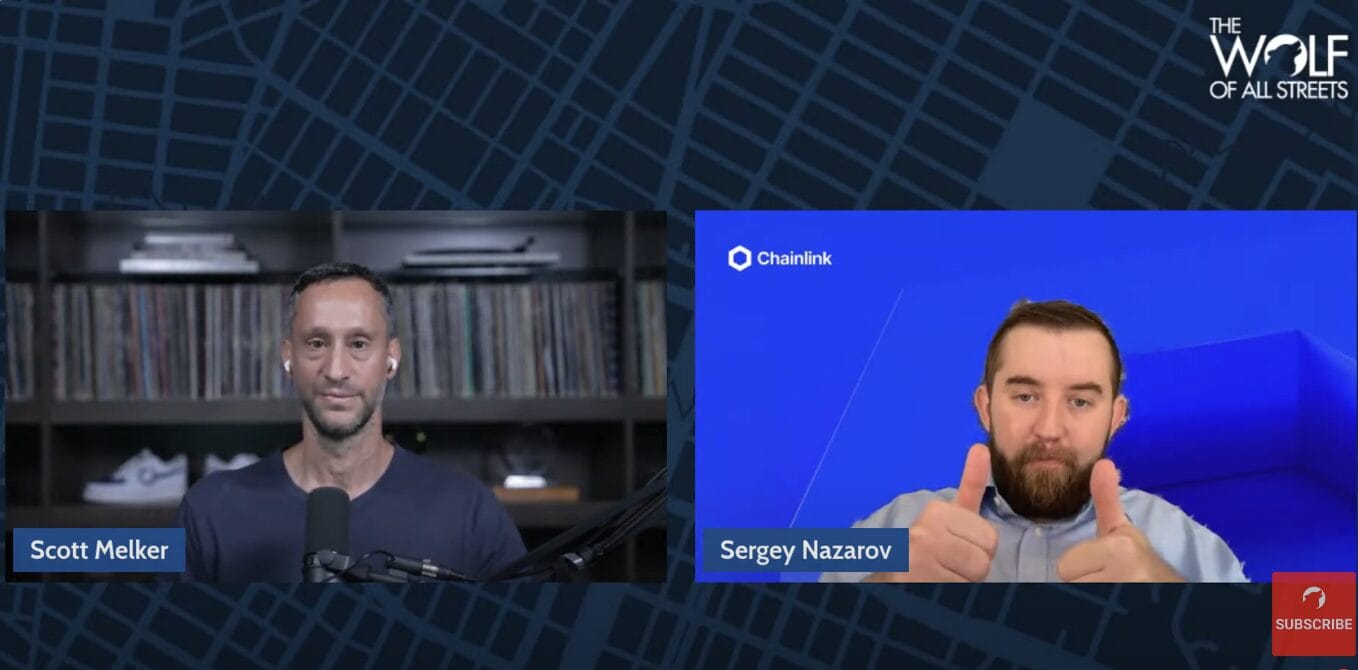

Yesterday, Chainlink co-founder Sergey Nazarov joined Scott Melker on The Wolf Of All Streets podcast to discuss the newly launched Chainlink Reserve, Chainlink’s growing adoption throughout capital markets, and how Chainlink-powered stablecoins and tokenized real-world assets (RWAs) are building a more accessible and efficient global onchain financial system.

The reserve operates as an extension of Chainlink’s Payment Abstraction system, which reduces friction within the network by allowing users to pay for Chainlink services in alternative assets that are automatically converted to LINK using Automation, Price Feeds, and Cross-Chain Interoperability Protocol (CCIP). Payment Abstraction now officially supports onchain and offchain payments.

“The Chainlink Reserve is basically the answer to the question of how does offchain revenue relate back to the Chainlink system,” Nazarov explained.

A growing number of large enterprises are paying offchain for access to the Chainlink platform. These offchain payments have created hundreds of millions of dollars in revenue and are expected to increase as traditional finance continues to integrate onchain.

“It became very clear to us that the Payment Abstraction layer had to handle offchain deal revenue,” said Nazarov.

Over $1M of this revenue has already been converted to LINK and placed in the reserve.

Nazarov last spoke to Melker in March, when he discussed the U.S. government’s shift to establish global leadership in blockchain and digital asset adoption. Since then, the House has passed several key pieces of legislation including the GENIUS Act, which establishes the first federal guardrails for USD-pegged stablecoins.

Chainlink has played a central role in shaping U.S. digital asset policy. Last month, Chainlink Labs was one of five new projects admitted to the SEC Crypto Task Force. A recent White House Digital Asset Report highlighted Chainlink oracles as a key technology for advancing stablecoin and RWA innovation.

“What’s important is that the legal environment is enabling both DeFi and TradFi to go onchain to generate high-quality tokenized assets, to allow those tokenized assets to be exchanged very efficiently cross-chain, to allow those tokenized assets to have proof of reserves and various other pieces of data that end up making those tokenized assets better than traditional financial assets,” Nazarov explained.

“This is beneficial not only to our industry, but it’s massively beneficial to the U.S.”

When asked if digital assets have entered their Goldilocks moment, he replied, “Yes, I think we’re there.”

Over the coming months and years, he expects an influx of institutional capital onchain while stablecoin adoption could increase 10x.

Ultimately, he believes the benefits of digital assets, including fractionalization, programmability, and atomic settlement, will facilitate a new and improved global financial system onchain.

“People will see massively superior clearing and settlement. They will see massively superior collateral management. They will see massive levels of previously unseen transparency and risk management. They will see things that were not possible before become possible overnight. ”

Watch the full interview.