Industry-standard oracle platform Chainlink is making a splash in New York City this week with its LINK Everything campaign. Ads reflect a new report and overview which highlight Chainlink’s standards and services as vital to scaling institutional blockchain use cases and unlocking the tokenized real-world asset (RWA) market, projected to reach $16 trillion by 2030.

LINK Everything echoes themes from SmartCon 2025, which took place at Manhattan’s Metropolitan Pavilion last month. During his SmartCon keynote, Chainlink co-founder Sergey Nazarov shined a spotlight on the Chainlink Runtime Environment (CRE) – a universal orchestration layer for building end-to-end institutional-grade smart contracts – as the key to bringing traditional finance “into the fold” onchain.

“That is the thing that’s going to both take our industry mainstream and enable this technology to get adopted in a way that actually powers the world, rather than just powering a subset of the world,” he told his audience at SmartCon.

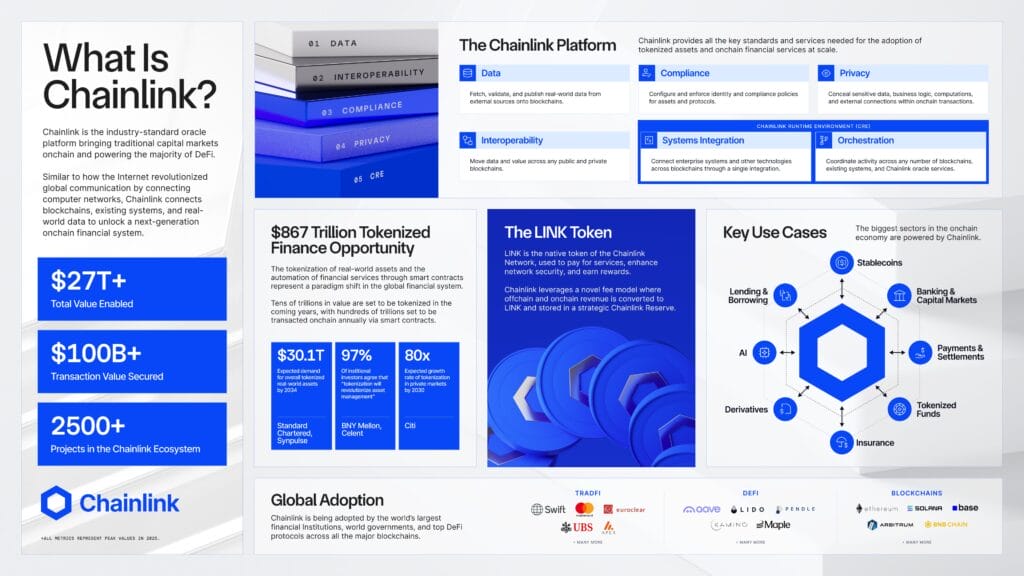

CRE introduces the capacity to manage multiple Chainlink oracle services such as Proof of Reserve, Automated Compliance Engine (ACE), and Cross-Chain Interoperability Protocol (CCIP) as a single piece of code, allowing developers to build multi-chain, multi-oracle, multi-jurisdictional smart contracts with inherent compliance and legacy system connectivity faster than ever before.

Designed to dramatically accelerate the rate at which institutional capital can flow onchain, CRE is built to capture the $867 trillion market opportunity for use cases including RWAs, stablecoins, and onchain delivery versus payment (DvP).

As of December 2025, Chainlink has securely enabled over $27 trillion in transaction value across 70+ blockchains. Chainlink has published over 18 billion total verified messages onchain and has actively secured over $100 billion across DeFi, with a Total Value Secured (TVS) market share of approximately 70% across all blockchains and over 80% on Ethereum.

LINK is the native token underpinning the Chainlink platform, used by organizations globally to pay for oracle services and by network service providers to enhance network security and earn rewards.

In August, Chainlink launched a strategic reserve as part of its Payment Abstraction system, which automatically converts alternative assets from onchain and offchain payments for Chainlink services into LINK. Demand for Chainlink has since generated hundreds of millions of dollars in revenue from large enterprises that have paid offchain for access to the Chainlink platform.